Breaking Down the Costs and Benefits of Bitcoin Mining Investment in America

As the sun rises over the landscape of the American West, it illuminates a rapidly evolving frontier—one fueled by the relentless thirst for Bitcoin and the burgeoning sector of cryptocurrency mining. Investing in Bitcoin mining in America has become a topic of fervent debate, blending complexity with the potential for significant gains. The journey begins with understanding the intricacies of mining machines and the pivotal role they play in this digital gold rush.

The first consideration for investors is the sheer cost of mining machines. Specialized mining rigs are central to the process, with some machines boasting the capability to process thousands of hashes per second. Depending on the hardware’s efficiency and initial price, these rigs represent a substantial upfront investment. However, beyond mere acquisition costs, there are operational expenses such as electricity and cooling systems that must also be factored into this financial puzzle. With fluctuating energy prices across different regions in the U.S., the choice of location can drastically impact the overall profitability of mining ventures.

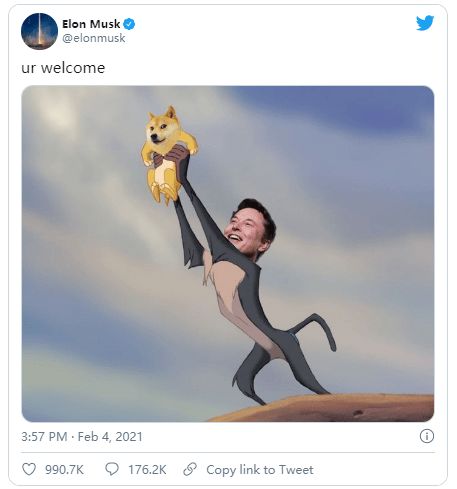

Furthermore, ample attention must be given to the cryptocurrency market itself. Bitcoin, Ethereum, and Dogecoin, each representing distinct investments and mining methodologies, fluctuate wildly in value. For example, while Bitcoin mining remains predominantly tethered to using ASIC miners, Ethereum still allows some flexibility with GPU mining. This variation leads to different purchase and operating strategies for potential miners, demanding a nuanced understanding of the current market landscape.

One of the hottest topics surrounding cryptocurrency investments is the potential for passive income through mining machine hosting. Hosting services provide miners with the opportunity to rent space and time on efficient mining rigs. By outsourcing their operations, individuals can focus on investment and strategy while leaving the technical worries to expert miners and facilities. This option not only lowers the barriers for newcomers intimidated by the setup and maintenance of mining farms but also allows them to scale their investments according to market trends.

The allure of a lucrative return beckons many investors to dive headfirst into the mining pool. Yet, careful planning is paramount. Understanding hash rates, mining difficulty, and potential revenue from block rewards is essential. For Bitcoin, the rewards for successful mining are halved approximately every four years in an event known as the “halving.” This phenomenon must be closely monitored, as it significantly influences profitability and investment viability. A deep dive into the empires being built around these digital currencies reveals a myriad of opportunities, but also pitfalls waiting to ensnare the unwary.

American regulations surrounding cryptocurrency are also crucial for investors to study. Each state tends to have its own laws regarding cryptocurrency mining, taxation, and business registration; these differences can create both challenges and opportunities. Certain states, like Texas, have built reputations as crypto-friendly havens with economic incentives for both large-scale mining operations and small ventures alike. Fluctuating policies can result in significant impacts on operations and profitability, urging miners to remain vigilant and adaptable in an ever-shifting landscape.

In the grand tapestry of cryptocurrency mining, community engagement often plays a critical role. Networking with other miners, tech experts, and regulatory bodies can inform more strategic approaches. A knowledge-sharing economy emerges, valuable for gaining insights into best practices, investment opportunities, or even troubleshooting technical issues with mining rigs. Collaboration can open doors not only to success in investment but also to innovation within the cryptosphere.

Finally, sustainability and energy efficiency are garnering increasing attention in the crypto mining narrative. As concerns over the environmental impact of Bitcoin mining grow, there is a push towards utilizing renewable energy sources. Modern miners are starting to lean into green energy options, which not only appeals to ethically minded investors but can also significantly reduce long-term operational costs. This shift poses an interesting juxtaposition to the traditional dependencies on fossil fuels, igniting debates on what the future of mining may entail.

In conclusion, investing in Bitcoin mining in America offers a landscape rich with challenges and opportunities. By understanding the myriad factors that influence this digital ecosystem—from mining machine costs and market volatility to hosting solutions and community engagement—investors can strategically position themselves at the helm of this technological revolution. The journey is not without its complexities, but for those equipped with knowledge and adaptability, the rewards may well be worth the endeavor.

One response

-

This article unpacks Bitcoin mining investments in America, exploring not only financial gains but environmental impacts, regulatory hurdles, and technological demands. It offers a nuanced view, balancing profit potential with sustainability concerns and highlighting emerging regional opportunities and challenges.

Fast Delivery

Free Shipping for order

Order tracking

Check your order status

Refunds

Free 100% money back

Support

Our team is feedback 24/7

Leave a Reply